Don't pay £600+ for software or waste time making your own spreadsheet when you can get our ...

UK Advanced Bookkeeping Template For Excel or Google Sheets

Built for United Kingdom small businesses just like yours!

Get Everything You Need

In our powerful Done-For-You Excel or Google Sheets template specifically designed for UK Small Businesses!

UK Business Settings

Built for UK small businesses, the template handles VAT and financial year setup with ease:

Enter your Business Name as you’d like it to appear on financial reports.

Includes the 20% Standard VAT Rate, the 5% Reduced VAT Rate and the 0% VAT Rate.

All VAT rates can be changed if you need to.

Input the Start Date of your financial year. The template will auto-fill the rest!

Add the Period Names you want displayed on your financial reports.

Chart of Accounts

Easily see where your money comes from and where it goes by keeping your income and expenses organised into separate categories:

Track up to 15 Revenue categories.

Track up to 50 Expense categories.

Track up to 5 Asset Purchase categories.

Choose whether VAT applies to each revenue, expense and asset purchase category.

Track Revenue by product (e.g. phone case), sales channel (e.g. Shopify), or any custom method that suits your business.

The categories you set up here will automatically appear in a convenient Drop-Down List when recording transactions.

Transactions

Record all your business transactions in one central location with full details

There's space for up to 20,000 transactions!

Built-in error checks ensure that only Valid Dates within your financial year can be entered.

VAT is Automatically Calculated so you don't have to do it yourself!

Enter an Overriding VAT amount if the automatic calculation isn't right.

Choose a revenue, expense or asset puchase category from a Drop-Down Menut linked to your Chart of Accounts.

Optionally enter a Reference Number (e.g. invoice number).

Attach Hyperlinks to documents on your device or cloud storage (e.g., Google Drive).

Error Checking ensures vital info such as dates and amounts is entered.

Income Statement

Easily monitor your business’s profitability using the detailed Income Statement, featuring comprehensive figures for:

Every Revenue and Expense category line by line.

Subtotals for Total Revenue and Total Expenses.

Each individual Month.

Totals for all four Quarters.

Total of the Full Year.

Total Profit/(Loss) for each month, each quarter and for the full year.

Year-To-Date Profit/(Loss) for each month, each quarter and for the full year.

Profit/(Loss) as a percentage for each month, each quarter, the full year and year-to-date.

Dashboard

An easy-to-read dashboard gives you a quick visual summary of how your business is doing, showing:

Year-To-Date totals for Income and Expenses.

Year-To-Date Profit/(Loss) as a number and percentage.

Total VAT incurred.

A chart that shows Profit/(Loss) by month.

A chart that shows Year-To-Date Profit/(Loss) by month.

A chart that show Income vs Expenses by month.

A chart that shows year-to-date Income by category.

A chart that shows year-to-date Expenses by category.

Summary Report

The Summary Report is ideal for your accountant during tax season, listing each Revenue, Expense, and Asset Purchase category with year-to-date figures for:

Each revenue and expense category.

Total Revenue and Expenses.

Each Asset Purchase category.

Total Asset Purchases.

Total Transactions including VAT.

Total VAT separated out.

Total Transactions excluding VAT.

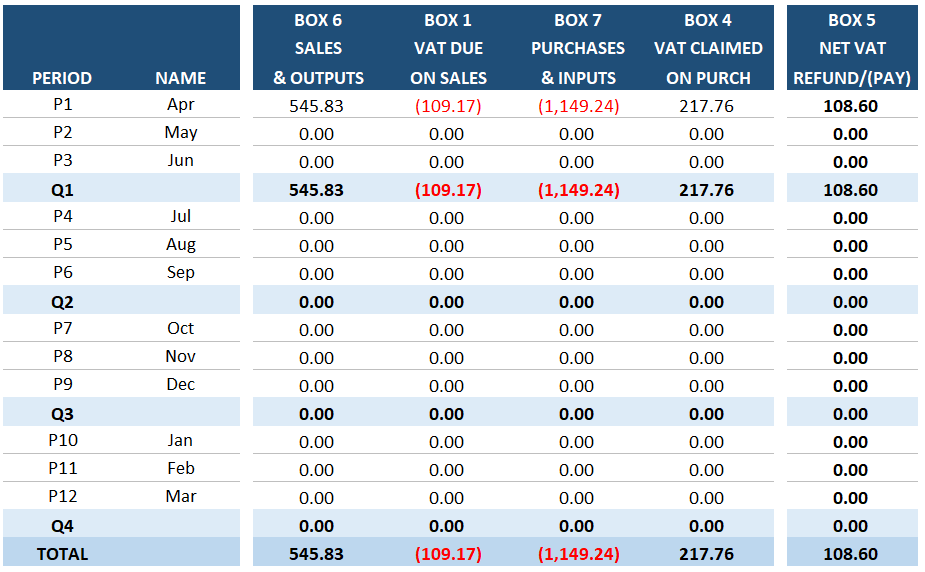

VAT Report and Calculator

Do you need to pay VAT for your business? Our template calculates all the numbers you need for your VAT Returns:

All key numbers by month, quarter and full year.

A handy VAT Query tool you can use to get all the key numbers by whatever date range you like.

Sales and Outputs by month, quarter and full year that you can use for Box 6.

VAT on Sales and Outputs by month, quarter and full year that you can use for Box 1.

VAT on Purchases and Inputs by month, quarter and full year that you can use for Box 7.

VAT claimed on Purchases and Inputs by month, quarter and full year that you can use for Box 4.

The Net Amount of VAT you need to pay or will receive as a refund by month, quarter and full year is calculated at Box 5.

Error Checking

Error checking and protective features ensure correct data entry and guard against accidental removal of critical formulas or functions:

Cells containing incorrect data will be Highlighted Red for easy identification.

If errors are detected, Warning Messages will prompt you to review them.

Cells with formulas and critical information are Locked and Protected to prevent accidental changes.

Transactions won’t appear in your reports until all required fields are completed correctly and free of errors.

For Example: the template only accepts dates within your financial year.

Video Instructions

Comprehensive Video Instructions guide you step-by-step to help you learn how to use the template quickly and easily:

Download a copy of the template.

Set up your business in the template.

Enter a variety of different transactions.

Sort your transactions in date order.

Easily find and fix errors.

And more!

PDF Instruction Book

The spreadsheet comes with a downloadable PDF Instruction Book that allows you to:

Skip the videos and find answers fast.

Keep a backup on your device for times you're offline.

Print it out and add your own notes if that helps.

Excellent Instructions

"Can not thank you enough for this spreadsheet and the tutorial. I appreciate you so!"

AXELLE - YouTube Comment

Best Spreadsheet Available

"This is the best spreadsheet available. You made it so easy to change the Category Names."

BRAD - YouTube Comment

Hi, I'm Mark Cunningham

And I built this template so you don't have to!

After spending too much money on fancy bookkeeping software, I've returned to using my own spreadsheet to do my business' bookkeeping.

Now I save £600 each year and I don't have to spend hours of my precious time learning how to use Xero or Quickbooks.

I want you to be able to do the same, so I created the Small Business Bookkeeping Template for The UK so you can:

Save thousands of dollars over the years

Save hours of your precious time

Avoid the cluttered Etsy templates

Easily calculate the numbers for your VAT Returns

And more!

Spoilt for Choice

"It’s well worth the price as using your spreadsheet means you can do your tax each day if needed or weekly, monthly or quarterly. Spoilt for choice :)"

STEVE - Shopify Seller

Saves Time and Money

"I run a restaurant and don't have time to create a bookkeeping template and I don't have money to spend on software. It's all draining. This is good!"

SUGI - Restaurant Owner

Smarter, Simpler Bookkeeping

Why this template is perfect your UK business ...

Easily Affordable

Say goodbye to expensive software! You'll Save a Fortune compared to pricey bookkeeping software like Xero or Quickbooks.

Uncluttered Design

Unlike the Etsy Templates, our design is clean and intuitive. No unnecessary graphs or budgets – just straightforward bookkeeping.

Built for The UK

The template is designed for small businesses in the United Kingdom just like yours so you can get the numbers for your VAT returns!

Easy to Learn

Our template is user-friendly and easy to understand. With Full Instructions, you'll be up and running fast.

So don't spend £600+ on software or waste time making your own spreadsheet when you can get our ...

Small Business Bookkeeping Template for The UK

For a very affordable one-time payment of only £27 GBP.

EXCEL VERSION

£27

GBP one-time payment

Do your bookkeeping in Microsoft Excel

Built for UK small businesses

15 Income categories

50 Expense categories

5 Asset purchase categories

20,000 Transactions

Full Video and PDF instructions

VAT calculations with Monthly, Quarterly and Annual numbers

Income Statement with Monthly, Quarterly and Annual numbers

Dashboard with key numbers and charts

Summary Report for your accountant

Built-in Error Checking

SHEETS VERSION

£27

GBP one-time payment

Do your bookkeeping in Google Sheets

Built for UK small businesses

15 Income categories

50 Expense categories

5 Asset purchase categories

20,000 Transactions

Full Video and PDF instructions

VAT calculations with Monthly, Quarterly and Annual numbers

Income Statement with Monthly, Quarterly and Annual numbers

Dashboard with key numbers and charts

Summary Report for your accountant

Built-in Error Checking

Got Questions?

We've got answers!

This bookkeeping template for Excel and Google Sheets is designed specifically for UK. No matter what type of business you're in, you can use this template to do basic bookkeeping, particularly if you have a new business or a small, uncomplicated business.

We have specific templates for some countries. If you want to request a template for your country please send us a message via the form on our Contact page.

Yes you can! Simply click on the button to choose the Excel version and you'll be taken to a checkout where you can make your payment. You will then be taken to a download page where you can download a copy of the Excel file.

Yes you can! Simply click on the button to choose the Google Sheets version and you'll be taken to a checkout where you can make your payment. You will then be taken to a download page where you can make a copy of the Sheets file.

This template calculates UK VAT based on the rates you enter when setting up the template. You can then allocate a VAT rate to each revenue, expense and asset purchase category in the chart of accounts.

No. You only need to buy the template once. You can then make as many copies as you like to use to multiple businesses and/or multiple financial years.

If you have a question simply contact us using the form on our Contact page.

© 2024 EASY BOOKKEEPING TEMPLATES